Introduction

The advent of big data has caused a transformational shift in the finance industry. Therefore, this marks the onset of the Big Data Revolution in Finance. Its most profound impact is that it has made big data analytics integral to financial institutions’ decision-making process. Thereby making decision-making far more data-driven. In response, financial institutions now leverage vast amounts of data to gain insights and drive innovation. Big data is revolutionizing risk management, fraud detection, and personalized banking. This article explores how big data shapes the future of finance, enhancing efficiency and customer experience.

1. Risk Management

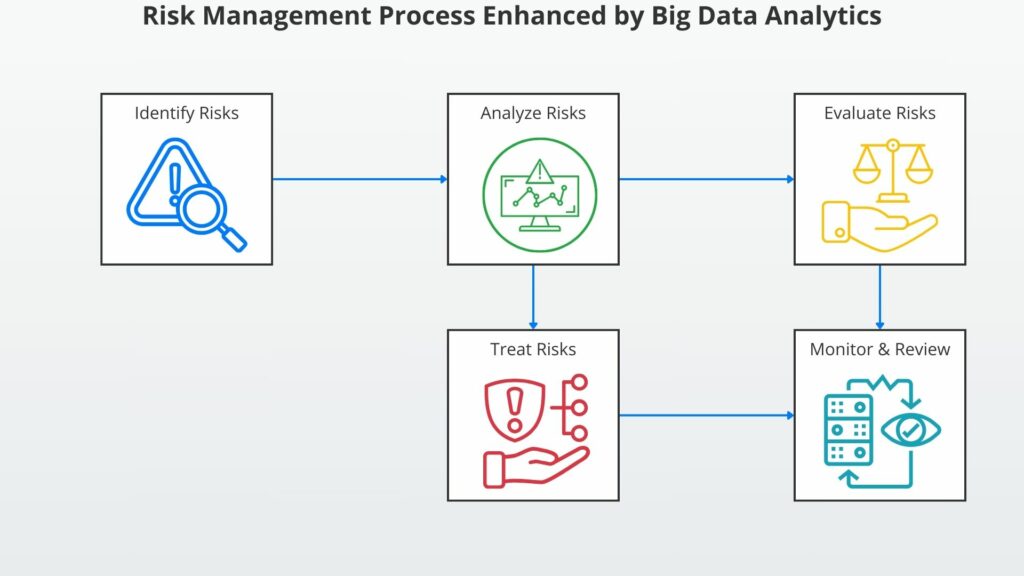

a. Predictive Analytics

The Big Data Revolution in Finance makes predictive analysis possible for data-driven financial forecasting. Financial institutions can, therefore, predict economic hazards in the future. This enables them to predict market patterns and modify their plans accordingly. Big data accomplishes this by offering sophisticated algorithms for pattern analysis that pinpoint possible danger indicators. Financial institutions can then use proactive risk management, which helps to reduce losses. Another advantage is that predictive analysis improves credit scoring model accuracy by increasing data-drivenness. The ability of financial institutions to customize risk assessments for specific clients is an additional advantage. Big data also makes it possible to monitor data, which leads to continuous real-time risk modifications. In conclusion, financial institutions reduce uncertainty by using big data to make more data-driven investment decisions.

b. Stress Testing

The Global Financial Crisis, COVID-19, and other events dramatically illustrated the need for financial institutions to withstand economic shocks. Therefore, governments and financial institutions introduced stress testing to evaluate how effectively they can handle these economic shocks. Because stress testing needs to simulate adverse market conditions comprehensively, big data simplifies this process and makes it less costly. The benefits include institutions accessing the resilience of their portfolios under various scenarios while identifying vulnerabilities within the financial system. Since financial institutions are critical to economic health, governments have introduced regulatory compliance and capital requirements. Therefore, making stress testing data-driven improves institutions’ regulatory compliance and adherence to capital requirements.

Further benefits of scenario analysis include insights into potential future crises. Institutions can then develop contingency plans based on these insights. Finally, stress testing contributes to overall financial stability.

c. Risk Assessment Models

Big data, by integrating diverse data sources, allows the building of sophisticated risk assessment models that provide comprehensive risk evaluation. Therefore, these models enhance predictive analysis and stress testing. They also enable machine learning algorithms to operate on this data and improve the predictive power of risk models. These models also make risk assessment at granular levels possible. Additionally, they provide data-driven insights, further improving risk management decision-making. Big data also allows real-time data to update models continually and enables dynamic risk assessments, making insights timely and current. Combined benefits from these enhanced models further reduce the likelihood of financial crises.

d. Portfolio Management

Portfolio management is a crucial activity for financial institutions, and big data analytics optimizes portfolio management strategies in several areas. Firstly, they make asset allocation and diversification far more data-driven, which improves returns on investment. Next, they enhance predictive model construction that forecasts asset performance and diversification. Big data also allows for managing real-time updates that enable timely portfolio adjustments. This also supports continuous data analysis that, in turn, promotes long-term portfolio growth. Another benefit is that financial institutions can use data-driven analysis to identify undervalued assets and investment opportunities. Finally, enhanced portfolio management reduces investment risk.

e. Regulatory Compliance

Authorities already heavily regulate the finance industry and are more likely to increase scrutiny. There are several ways that the big data revolution in finance can assist financial institutions in meeting regulatory oversight. First, big data makes the compliance process far more data-driven, which reduces the risk of penalties and sanctions. Next, financial institutions can apply advanced analytics that big data provides to streamline compliance processes. Also, big data offers predictive analytics that can identify potential compliance breaches before they occur. Because big data supports real-time updates, continuous monitoring is possible to ensure ongoing regulatory alignment. This also allows institutions to monitor and report regulatory adherence in real-time. Finally, this enhances transparency, which builds trust with regulators and stakeholders.

2. Fraud Detection

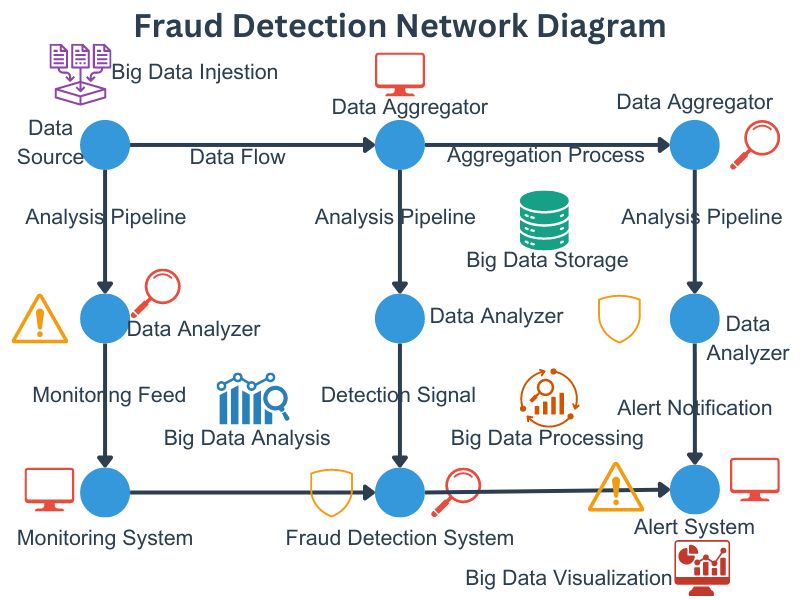

Technological progress has enabled criminals to invent new ways to defraud financial institutions. The big data revolution in finance offers various tools and processes promising to thwart criminal activities.

a. Real-Time Monitoring

Big data supports monitoring and processing data generated in real-time. Therefore, it can monitor and process financial transactions in real time and in large volumes. This real-time monitoring fosters a secure financial environment in several ways. Financial institutions can apply advanced algorithms to detect suspicious activities instantaneously. Thus enabling real-time alerting for prompt investigation and action. This, in turn, reduces the window of opportunity for fraudsters. Monitoring provided by big data also improves the accuracy of fraud detection. Finally, applying big data to financial transactions provides data-driven insights that support proactive fraud prevention measures.

b. Machine Learning Algorithms

Big data can handle large volumes of data in real time. This enables machine learning algorithms to work with vast datasets to identify fraudulent patterns, further enhancing fraud detection capabilities. Machine learning also makes models far more data-driven, which reduces false positives in fraud detection. Managing data in real time also allows machine learning algorithms to update their models in real-time and apply continuous learning. This continuous learning improves the accuracy of fraud detection models. This, in turn, allows fraud prevention to adapt to emerging fraud tactics while continually improving. These machine-learning algorithms allow financial institutions to better identify complex and sophisticated fraud schemes and perform predictive fraud detection.

c. Behavioral Analysis

Big data allows financial institutions to apply behavioral analysis to large volumes of financial transactions and their real-time updates. This continuous monitoring identifies deviations from normal behavior. Therefore, Institutions use behavioral analysis to detect anomalies in user behavior, leading to the identification of unusual spending patterns. Behavioral analysis also makes insights more data-driven, revealing potential fraud indicators and reducing the risk of financial fraud. Furthermore, this supports the detection of identity theft and account takeover. Enhanced behavioral analysis through big data improves fraud detection accuracy and allows institutions to implement targeted fraud prevention measures.

d. Network Analysis

Big data makes it possible to uncover fraudster networks by analyzing large volumes of financial transactions, making these insights data-driven. This allows the application of advanced algorithms that allow institutions to analyze transaction networks for suspicious links. Therefore, identifying fraud links and collusion as well as detecting organized fraud. Big data’s real-time data handling provides continuous monitoring that reveals evolving fraud tactics. Subsequently, financial institutions can use these insights from network analysis to implement targeted investigations. Thereby disrupting fraud networks and enhancing overall fraud prevention efforts.

e. Anomaly Detection

As mentioned earlier, anomaly detection is a key component of fraud detection. Big data makes this possible on a far broader scale through the ability to analyze large volumes of financial transactions. Subsequently, anomaly detection algorithms can identify unusual financial transactions and flag these transactions deviating from normal patterns. This can also be done in real-time through continuous monitoring while adapting to new and evolving fraud tactics. Financial institutions can then investigate these flagged anomalies promptly and improve the accuracy of fraud prevention measures. Overall, these will make financial transactions more secure.

3. Algorithmic Trading

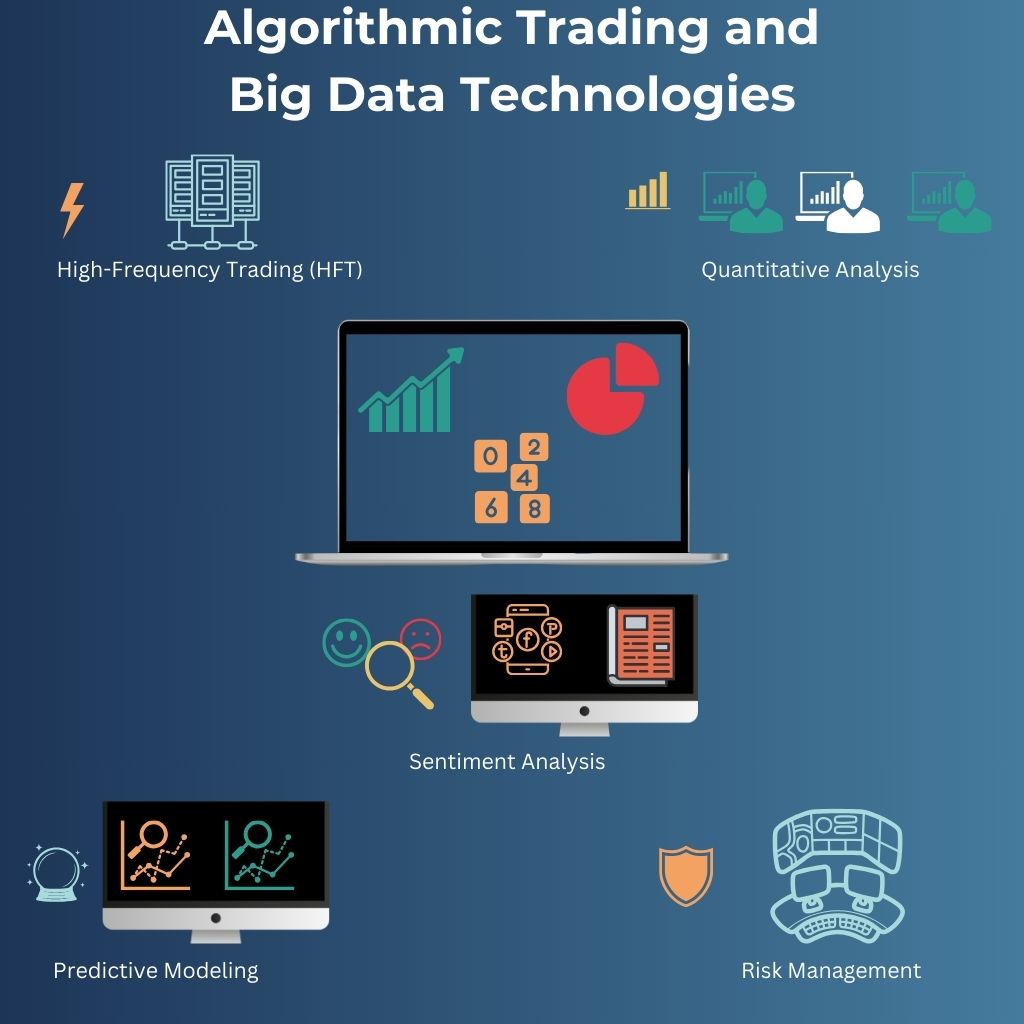

Trading decisions rely on diverse data from diverse sources, making it an ideal candidate for big data support. This is another impact of the big data revolution in finance.

a. High-Frequency Trading (HFT)

HFT utilizes the premise that financial institutions can capitalize on small price movements. This approach involves accumulating small profits by capitalizing on minor price movements. High-frequency trading, by definition, involves making numerous transactions quickly, relying on real-time data feeds for market analysis. Big data technologies that support HFT include data streaming and NoSQL databases. Streaming allows data processing in real time, while a NoSQL database allows high-speed access for lightning-speed analysis. This allows advanced algorithms to execute trades at lightning speed while basing split-second trading decisions on data-driven insights. This reduces the impact of human error. These strategies, in turn, improve market efficiency through efficient matching of orders, enhanced competition, and increased liquidity.

b. Quantitative Analysis

Quantitative analysis employs advanced models, such as time series analysis and machine learning. These scrutinize historical and real-time market data to identify trends. These insights underpin the development of sophisticated trading algorithms that leverage data-driven strategies. Big data technologies include distributed file systems, data lakes, and stream processing. These are instrumental in managing and accessing vast quantities of structured (e.g., financial statements) and unstructured data (e.g., news articles). Quantitative analysis enhances market prediction accuracy by combining high-speed access to historical and real-time data. This leads to reduced trading risks and improved overall performance.

c. Sentiment Analysis

Sentiment is a key driver of financial markets, and sentiment analysis is an important information source for data-driven trading strategies. These sources include news and social media. Sentiment analysis derives insight into market mood from this information. Trading applies these insights for trading decision-making and identifying shifts in investor sentiment. Several big data technologies that support sentiment analysis include data pipelines, distributed file systems, data processing, and natural language processing. Data pipelines enable data collection from news and social media sources. Because this data is high volume, distributed file systems and NoSQL manage storage and access. Data processing transforms this data into schemas for analysis. Natural language tools are helpful for categorizing market sentiment from these sources.

d. Predictive Modeling

An important tool for algorithmic trading is predictive modeling, which forecasts market movements. They allow advanced algorithms to analyze historical and real-time data to derive data-driven predictive insights. An example is time series analysis. Financial institutions then use these insights to anticipate market trends and adjust strategies. The big data revolution in finance supports predictive modeling through several technologies. Distributed file systems and NoSQL databases store and provide access to historical data that predictive models need for analysis. Batch processing allows predictive models to transform data in a schema suitable for analysis and perform analysis on historical data. Stream analysis allows real-time data processing for timely predictions. Distributed queries support these tools by building models from complex historical data queries. This predictive modeling enhances overall trading performance through timely adjustments based on data-driven forecasts.

e. Risk Management in Trading

Data-driven risk management strategies allow financial institutions to implement dynamic risk adjustments. Subsequently, they can reduce the impact of market volatility. Big data supports risk management formulation and continual adjustment through several technologies. Data ingestion and streaming provide timely data, ensuring insights are not stale. Distribution file systems, including NoSQL databases, provide storage and fast access to large data volumes that risk models depend on. Stream data processing (e.g., Apache Spark) allows the application of algorithms to live data in real-time. Machine learning and statistical frameworks (e.g., TensorFlow and PyTorch) allow the construction of advanced algorithms. These, in turn, provide data-driven insights into risk. These risk management strategies contribute to long-term trading success through the active reduction of risk.

4. Personalized Banking Services

Financial institutions, at the end of the day, sell to customers. Therefore, they must analyze market and customer data to compete more effectively. The big data revolution in finance improves financial institutions’ ability to utilize market and customer data. Thereby gaining a competitive advantage.

a. Customer Segmentation

Financial institutions must perform customer segmentation as part of their overall marketing strategy. Insights from customer segment analysis allow them to select high-value segments and tailor marketing strategies for each segment. Making customer segment analysis data-driven reduces uncertainty from these insights, improving customer satisfaction and banking services relevancy. Customer and market data is diverse and high volume, which necessitates the application of several big data technologies. Data warehousing stores data from diverse sources and schemas, including unstructured data for analysis. Various analysis tools applied to this data include data mining, natural language processing, cluster analysis, and predictive analytics.

b. Personalized Recommendations

Not only must financial institutions target customer segments, but they must target individual customers. Therefore, they must adopt a fine-grained approach to marketing strategies. A data-driven approach to insights for each customer allows them to tailor products and services for that customer. Also, this helps them to continually adapt to each customer’s evolving needs and preferences. Data warehouses store diverse and large data volumes needed for deriving meaningful insights into customer preferences. Batch and stream processing frameworks allow the construction of analysis tools that derive meaningful insights from that data. These tools then discover patterns and correlations with large customer datasets.

c. Customer Experience

Customer experience complements targeted marketing by managing all aspects of the customer’s journey and experience. Financial institutions must reduce or eliminate pain points in the customer journey. They must also identify areas for enhancement and make the whole experience seamless. Improved customer experience will foster customer satisfaction, retention, and long-term loyalty. The big data revolution in finance provides data-driven customer experience insights that will dramatically support proactive improvements in customer service. Data collection and storage of diverse and high-volume customer data will support this through high-speed access. Stream and batch processing frameworks allow the building of powerful customer experience analysis tools deriving valuable data-driven insights. These integrate with CRM and data visualization technologies to derive real-time insight into customer behavior.

d. Customer Support

An essential component of customer experience is customer support, which addresses any issues. Effective proactive measures improve the prevention of customer issues, while remediation will repair any damaged customer experience better. Data-driven customer support provides insight into proactive measures and improvement of remediation efforts. Customer support data is also high volume, comes from diverse sources, and exists in various structured and unstructured formats. Big data distributed file systems and data lakes manage this support data and provide high-speed access for further analysis. Stream and batch processing frameworks support analysis tools for timely and data-driven insights that customer support systems can utilize. Big data tools also integrate this data pipeline with CRM systems, providing integration with customer support systems.

e. Financial Planning

Financial planning is a lucrative product offered by the financial industry. It uses customer and financial data to formulate plans and advice for customers. Financial institutions that apply big data benefit because customer and financial data are diverse and high volume. Data warehouses store such data for further analysis. Data mining discovers patterns and relationships in the large dataset that provide data-driven insights into customer behaviors and preferences. Stream and batch processing frameworks allow for building power analytics tools that deliver insights and actions based on financial trends. Financial institutions can adapt plans to evolving circumstances. These contribute to financial planners’ ability to enhance customer satisfaction.

Conclusion

This article has provided several examples of how big data revolutionizes the finance industry. It allows the finance industry to leverage data from diverse sources, which occurs in large datasets. The leading technologies are storage for high-speed access and powerful analytics tools that derive valuable insights, making decisions more data-driven. Key areas are risk management, fraud detection, algorithmic trading, and personalized banking. Big data evolution will further impact the finance industry, making it far more data-driven.